Understanding Spot Price and Premium When Buying Gold Bars

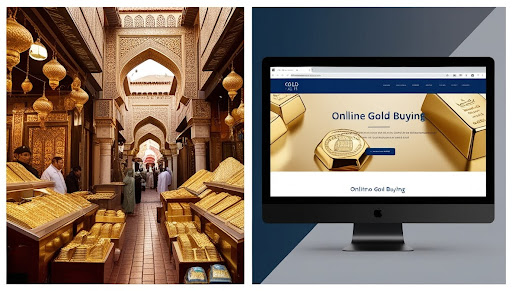

Learn the essential relationship between gold spot price and gold premium. Discover how these two elements determine the final price of gold bars, what influences premiums, and how to make informed buying decisions in Dubai's gold market.

If you've ever checked the gold price online and then looked at the actual price of a gold bar, you've probably wondered:

- Why does a gold bar cost more than the gold price shown on charts?

- And more importantly, am I paying the right price?

For anyone buying physical gold, especially in a global gold hub like Dubai, understanding the relationship between the gold spot price and the gold premium is essential. These two elements together determine what you finally pay for a gold bar.

This guide explains what the gold spot price is, how the gold spot price is determined, what a gold premium means, and how both affect the price of gold bars, so you can buy with clarity and confidence.

Table of Contents

- What Is the Gold Spot Price?

- How Gold Spot Price Is Determined

- What Is Gold Premium?

- Why Gold Bars Are Priced Above the Spot Price

- How Live Gold Prices Work When Buying Gold Bars Online

- What Influences Gold Premiums?

-

- 6.1 Gold Bar Size

- 6.2 Minted vs Cast Gold Bars

- 6.3 Market Demand

- Gold Spot Price vs Gold Premium: A Clear Comparison

- Which Gold Bars Typically Have Lower Premiums?

- Are Higher Gold Premiums Ever Worth It?

- Tips for Comparing Gold Bar Prices Smartly

- Final Thoughts

1. What Is the Gold Spot Price?

The gold spot price is the current market price of gold for immediate settlement. It is usually quoted per troy ounce but can also be calculated per gram.

In simple terms, the gold spot price represents:

- The pure value of raw gold

- A global reference price used across markets

- A price that updates continuously based on trading activity

This price is universal, meaning the gold spot price in Dubai closely tracks international markets. However, the spot price applies to unrefined or bulk gold, not finished physical products like gold bars.

2. How Gold Spot Price Is Determined

A common question among buyers is how the gold spot price is determined.

The gold spot price is shaped by real-time activity in global commodities markets and is influenced by:

- International supply and demand for gold

- Trading on exchanges such as the LBMA and COMEX

- Movements in the US dollar

- Inflation, interest rates, and central bank policies

- Geopolitical uncertainty and safe-haven demand

In addition to these global benchmarks, Dubai's position as the "City of Gold" also plays a role in how spot prices are reflected locally. Dubai's highly active physical gold trade, transparent pricing environment, and close alignment with international markets make it a key reference point for spot pricing in the regional market.

Because gold is traded worldwide and Dubai closely tracks these global benchmarks, the gold spot price fluctuates throughout the day, reflecting changing market conditions rather than local pricing decisions.

3. What Is Gold Premium?

Once you understand the spot price, the next piece of the puzzle is what the gold premium is.

The gold premium is the additional amount charged above the gold spot price when you buy a physical gold bar. This premium exists because turning raw gold into a certified, tradable gold bar involves real costs.

Gold premium typically covers:

- Refining and minting

- Secure packaging and certification

- Transportation and insurance

- Operational and dealer costs

So, the final gold bar price is not arbitrary—it is the result of:

Gold Spot Price + Gold Premium = Gold Bar Price

4. Why Gold Bars Are Priced Above the Spot Price

In highly transparent markets like the UAE, buyers often track live gold prices closely. However, it's important to remember that the gold spot price alone does not represent the cost of owning physical gold.

For example, if the live gold spot price in Dubai is AED X per gram and a 10g gold bar is priced at AED Y, the difference reflects:

- Manufacturing and minting

- Secure handling and logistics

- Certification and quality assurance

This is not a markup on gold itself—it's the cost of converting gold into a reliable investment-grade product.

5. How Live Gold Prices Work When Buying Gold Bars Online

When buying gold bars online, pricing usually adjusts in line with live gold spot prices.

Here's how it works:

- The gold spot price changes continuously throughout the day

- Gold bar prices update frequently to reflect these changes

- Gold premiums tend to remain relatively stable in comparison

This means your final price is primarily determined by the gold market, rather than arbitrary pricing shifts, which is especially important for buyers tracking gold bar price trends.

6. What Influences Gold Premiums?

Gold premiums are not fixed and can vary depending on several factors.

6.1 Gold Bar Size

Smaller gold bars usually have a higher premium per gram because production and handling costs are spread over less gold. Larger bars often provide better value for long-term investors.

6.2 Minted vs Cast Gold Bars

Minted gold bars have refined finishes, precise dimensions, and tamper-proof packaging, which increases their premium.

Cast gold bars are simpler to produce and typically come with lower premiums.

6.3 Market Demand

During periods of high demand or supply constraints, gold premiums may rise even if the gold spot price remains steady.

7. Gold Spot Price vs Gold Premium: A Clear Comparison

| Aspect | Gold Spot Price | Gold Premium |

|---|---|---|

| What it represents | Market value of raw gold | Cost of producing and selling physical gold |

| Set by | Global commodities markets | Refiners, mints, and sellers |

| Frequency of change | Constant | Varies by product and demand |

| Applies to | All gold globally | Only physical gold products |

Understanding this distinction helps buyers compare gold bar prices more accurately.

8. Which Gold Bars Typically Have Lower Premiums?

For buyers focused on value, certain gold bars usually carry lower premiums:

- Larger-weight gold bars

- Cast gold bars

- Bars designed for investment rather than gifting

Minted bars, while slightly higher in premium, are often preferred for presentation, gifting, and ease of resale.

9. Are Higher Gold Premiums Ever Worth It?

A higher gold premium is not necessarily a disadvantage. It can be justified when:

- The gold bar comes from a reputed refinery

- The product includes certification and secure packaging

- Liquidity and resale confidence are priorities

The key is understanding why a premium exists rather than simply looking for the lowest price.

10. Tips for Comparing Gold Bar Prices Smartly

Before buying gold bars, consider the following:

- Track the live gold spot price

- Compare gold premiums, not just total prices

- Match bar type and size to your investment goals

- Focus on transparency and certification

This approach helps you avoid confusion and make rational, informed decisions.

11. Final Thoughts

Understanding the relationship between the gold spot price and gold premium removes much of the uncertainty around buying gold bars. While the spot price reflects the global value of gold, the premium explains the real-world costs of owning it in physical form.

By knowing how the gold spot price is determined and what a gold premium truly represents, buyers are better equipped to evaluate prices, compare gold bar options, and make decisions based on transparency rather than assumptions. This level of clarity is especially important in gold markets like Dubai, where pricing closely follows global benchmarks and buyers expect high standards of trust and accuracy.

At Modern Gold, we put this knowledge into practice by offering a pricing structure built on transparency. By pairing real-time, fair spot rates with reduced premiums, we ensure our valued customers can maximise their capital, turning every purchase into a more powerful vehicle for saving and long-term investment.

Ready to Start Your Gold Investment Journey?

Explore our certified minted gold and silver bars