Will Physical Gold Bars Remain a Safe Haven Asset in 2026?

Explore why gold is considered a safe haven asset and whether physical gold bars will continue to protect wealth in 2026. Learn about gold price predictions, Dubai's role in gold trading, and why physical gold remains relevant for investors.

Whenever global uncertainty rises, whether due to inflation, economic slowdowns, or geopolitical tensions, investors often return to a familiar question:

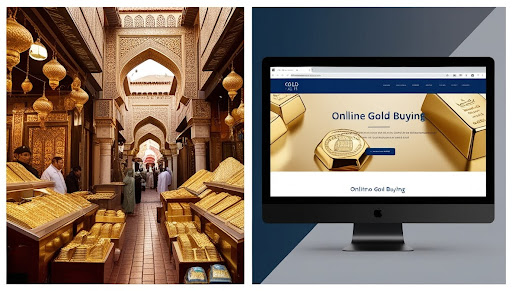

Is gold a safe haven?

In a city like Dubai, where gold trading is deeply embedded in both investment culture and daily commerce, this question carries even more weight. As we look ahead to 2026, many buyers and investors are reassessing whether physical gold bars will continue to protect wealth amid changing financial conditions.

This guide explores why gold has long been considered a safe haven asset, what current trends suggest about gold price prediction for 2026, and why physical gold bars remain especially relevant for investors in Dubai and the UAE.

Table of Contents

- Why Gold Is Considered a Safe Haven Asset

- Why Physical Gold Bars Matter More Than Ever

- Dubai's Role in Gold's Safe Haven Status

- Key Factors Influencing Gold's Outlook Toward 2026

-

- 4.1 Inflation and Purchasing Power

- 4.2 Interest Rate Uncertainty

- 4.3 Geopolitical and Economic Risks

- 4.4 Central Bank Gold Reserves

- Gold Price Prediction 2026: What the Outlook Suggests

- Is Gold a Safe Haven in a World of Digital Assets?

- Why Physical Gold Bars Continue to Appeal in the UAE

- What Could Challenge Gold's Safe Haven Role?

- How Investors in Dubai Can Think About Gold in 2026

- Final Thoughts

1. Why Gold Is Considered a Safe Haven Asset

A gold safe-haven asset is valued for its ability to preserve wealth during periods of uncertainty. Gold has earned this reputation over centuries because it:

- Holds intrinsic value independent of governments or institutions

- Is globally recognised and easily tradable

- Acts as a hedge against inflation and currency depreciation

- Tends to remain stable when equity and bond markets fluctuate

For investors in Dubai, one of the world's most transparent gold markets, gold's role as a store of value is reinforced by strong regulatory standards and global pricing benchmarks.

This historical resilience forms the basis of the recurring question: Is gold a safe haven even in today's modern financial system?

2. Why Physical Gold Bars Matter More Than Ever

Gold can be owned in several forms, but physical gold bars hold a unique position, especially in the UAE.

Physical gold bars:

- Involve no counterparty or credit risk

- Exist outside the banking system

- Are directly linked to live global gold prices

- Offer clarity in purity, weight, and valuation

In Dubai, where buyers often track live prices closely and expect high standards of certification, physical gold bars provide reassurance that paper or digital instruments cannot always offer.

3. Dubai's Role in Gold's Safe Haven Status

Dubai's position as a global gold hub strengthens gold's appeal as a safe-haven asset.

Key factors include:

- Transparent pricing linked to international gold spot prices

- Strong demand from investors, traders, and central institutions

- Well-established refining, certification, and trading infrastructure

These factors make gold, particularly physical gold bars, a trusted choice for long-term wealth preservation in the UAE.

4. Key Factors Influencing Gold's Outlook Toward 2026

Several global and regional trends will shape how investors view gold over the next few years.

4.1 Inflation and Purchasing Power

Inflation continues to affect currencies worldwide. Historically, gold has helped preserve purchasing power when inflation erodes the value of cash holdings.

4.2 Interest Rate Uncertainty

While rising interest rates can influence short-term gold demand, uncertainty around long-term monetary policy often reinforces gold's role as a stabilising asset.

4.3 Geopolitical and Economic Risks

Global trade tensions and geopolitical developments tend to increase demand for assets that are neutral, liquid, and globally accepted, qualities that gold possesses.

4.4 Central Bank Gold Reserves

Central banks across various regions have steadily increased gold holdings, signalling continued confidence in gold's long-term relevance within the global financial system.

5. Gold Price Prediction 2026: What the Outlook Suggests

When discussing gold price prediction for 2026, most analysts avoid extreme forecasts and instead focus on long-term support levels.

Key drivers influencing gold price expectations include:

- Inflation trends and sovereign debt levels

- Central bank reserve diversification

- Continued demand for physical gold in major markets like the UAE

Rather than sharp price spikes, many forecasts point toward sustained demand and relative price stability, which is precisely what safe-haven investors seek.

6. Is Gold a Safe Haven in a World of Digital Assets?

With digital investments gaining attention, some investors question whether gold's relevance is fading.

However, gold differs fundamentally because:

- It does not depend on technology or infrastructure

- It has a proven track record spanning centuries

- It remains universally valued across cultures and economies

In Dubai's diversified investment landscape, gold often complements modern assets rather than competing with them, offering balance when higher-risk investments become volatile.

7. Why Physical Gold Bars Continue to Appeal in the UAE

For investors in Dubai, physical gold bars offer several long-term advantages:

- Clear purity standards and internationally accepted formats

- Easy valuation based on live gold prices

- Strong liquidity and resale confidence

- Alignment with both investment and wealth-preservation goals

These factors explain why physical gold bars remain central to safe-haven strategies in the region.

8. What Could Challenge Gold's Safe Haven Role?

A balanced view is important. Gold is not immune to short-term fluctuations.

Potential challenges include:

- Extended periods of high interest rates

- Short-term corrections in gold prices

- Temporary shifts in investor sentiment toward risk assets

Historically, however, such factors have affected gold temporarily rather than diminishing its long-term role as a safe haven.

9. How Investors in Dubai Can Think About Gold in 2026

Instead of focusing on short-term price movements, many investors view gold as a tool for:

- Portfolio diversification

- Risk management

- Long-term capital protection

In this context, physical gold bars align well with Dubai's investment culture, which values transparency, liquidity, and tangible assets.

10. Final Thoughts

So, will physical gold bars remain a safe haven asset in 2026?

Looking at historical performance, current economic conditions, and Dubai's strong gold ecosystem, gold's core role appears firmly intact.

While markets evolve and new investment options emerge, gold continues to answer the fundamental question many investors ask during uncertain times: is gold a safe haven?

In a market like Dubai, where live pricing transparency, certification standards, and investor awareness are high, platforms such as Modern Gold reflect how traditional safe-haven assets have adapted to modern expectations. With pricing aligned to global markets and clearly defined product standards, investors are better positioned to approach gold ownership with clarity, confidence, and a long-term perspective.

As 2026 approaches, physical gold bars are likely to remain not just a symbol of stability but a practical component of thoughtful portfolio planning in the UAE.

Ready to Start Your Gold Investment Journey?

Explore our certified minted gold and silver bars