Main Drivers for Investors Shifting to Physical Gold

Discover why investors in the UAE and GCC are increasingly turning to physical gold. Explore the key drivers including inflation protection, currency stability, geopolitical security, and the advantages of tangible assets over paper gold.

Table of Contents

- Why Investors in the UAE Are Turning to Physical Gold

- Physical Gold vs. Paper Gold: What's Changing the Trend?

- Key Drivers Behind Rising Physical Gold Investment

-

- • 3.1. Inflation, Economic Cycles and Wealth Protection

- • 3.2. Currency Fluctuations and Global Devaluation Pressures

- • 3.3. Geopolitical Tensions and Regional Stability Concerns

- • 3.4. A Safe-Haven Asset Trusted in the Middle East

- • 3.5. Zero Counterparty Risk and Full Ownership

- • 3.6. Surging Physical Gold Demand in the UAE and GCC

- • 3.7. Improved Access Through Trusted Dubai Gold Retailers

- Why Invest in Physical Gold in the UAE Today?

- Who Should Consider Physical Gold Investment?

- Final Thoughts

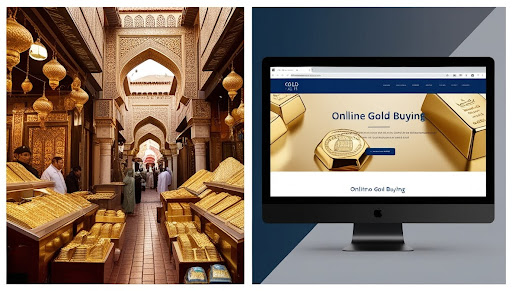

1. Why Investors in the UAE Are Turning to Physical Gold

Dubai has long been known as the City of Gold, and recent years have seen a strong return to physical gold investment among residents, expatriates, and regional investors.

In a world of uncertain markets and shifting global dynamics, more people are choosing real, tangible assets, especially gold, to safeguard their wealth.

Dubai's reputation for purity, transparency, tax-free gold buying, and globally competitive pricing plays a major role in this rising trend.

2. Physical Gold vs. Paper Gold: What's Changing the Trend?

Digital gold options such as ETFs or gold-backed securities offer convenience but also depend on financial institutions, market stability and digital systems.

Physical gold, however, offers:

- Full ownership

- No counterparty risk

- A globally recognised store of value

- Independence from digital platforms or intermediaries

In a region prioritising wealth preservation and long-term security, this shift makes perfect sense.

3. Key Drivers Behind Rising Physical Gold Investment

3.1 Inflation, Economic Cycles and Wealth Protection

Even in strong economies like the UAE, inflation affects daily expenses, long-term savings and purchasing power.

Gold has historically acted as a hedge during inflationary cycles because:

- It maintains long-term value

- Its price often rises when currencies weaken

- It provides stability during economic downturns

This is one of the biggest reasons behind rising physical gold demand globally and in the Middle East.

3.2 Currency Fluctuations and Global Devaluation Pressures

The UAE Dirham is pegged to the US Dollar, meaning global dollar movements directly affect purchasing power and investment portfolios.

With multiple currencies weakening worldwide, investors see gold as a stable anchor that does not rely on the political or economic performance of any one country.

Physical gold maintains universal value, a major advantage for expatriates who hold wealth across multiple currencies.

3.3 Geopolitical Tensions and Regional Stability Concerns

The Middle East is a region that closely tracks global geopolitical shifts. Conflicts, energy-market uncertainty, and global trade tensions often push investors toward safe-haven assets.

Gold remains the top choice because it:

- Performs well in periods of uncertainty

- Is not tied to any government or financial system

- Offers long-term protection from geopolitical risk

These conditions continue to increase physical gold demand across the GCC.

3.4 A Safe-Haven Asset Trusted in the Middle East

Gold has deep cultural significance across the UAE, Saudi Arabia, Oman, Qatar, Bahrain and the wider MENA region. Families often pass gold across generations, viewing it as timeless wealth.

Modern investors are simply extending a long cultural tradition, but with a more strategic, portfolio-driven approach.

3.5 Zero Counterparty Risk and Full Ownership

One of the strongest reasons why invest in physical gold is the control it gives investors.

Unlike digital or financial assets:

- Physical gold cannot be frozen

- It cannot be defaulted on

- It carries no bank dependency

- It is not affected by digital outages

Investors in Dubai appreciate the certainty of holding a real asset that belongs 100% to them.

3.6 Surging Physical Gold Demand in the UAE and GCC

The UAE consistently ranks among the world's top consumers of gold. Contributing factors include:

- Tax-free gold purchases

- Trusted gold souks and bullion brands

- Competitive pricing due to Dubai's global import hubs

- Strong demand from residents, tourists and high-net-worth individuals

This regional confidence further strengthens the appeal of physical gold investment.

3.7 Improved Access Through Trusted Dubai Gold Retailers

Modern platforms like Modern Gold have made physical gold easier and safer to buy than ever before.

Today's investors benefit from:

- Certified gold bars and coins

- Guaranteed purity (usually 999.9)

- Secure packaging and authenticity certificates

- Transparent pricing

- Reliable delivery and storage options

This ease of access has opened the market to younger investors and first-time buyers.

4. Why Invest in Physical Gold in the UAE Today?

Here's what makes the timing ideal:

- Market volatility continues worldwide

- Inflationary pressure remains

- Gold is approaching long-term upward price cycles

- Demand from Asian and Middle Eastern markets is rising

- Physical gold outperforms many paper assets in crises

Buying physical gold today allows investors to secure real, globally recognised wealth that can be passed on, liquidated easily or held as a long-term safety net.

5. Who Should Consider Physical Gold Investment?

Physical gold is especially suitable for:

- Long-term investors

- Individuals planning generational wealth transfer

- Anyone seeking protection from inflation

- Expatriates with multi-currency exposure

- Families who value tangible, secure assets

- Investors building a diversified portfolio

Even beginners can start with small denominations of minted or cast bars.

6. Final Thoughts

The UAE's unique position as a global gold hub makes physical gold investment more attractive than ever. With rising global uncertainty and long-term wealth preservation becoming a priority, physical gold stands out as a stable, reliable and time-tested asset.

For investors wondering why to invest in physical gold, the answer is simple:

Because physical gold is wealth you can see, hold and rely on, no matter what happens in the world.

Ready to Start Your Gold Investment Journey?

Explore our certified minted gold and silver bars